Xiaomi Is The World’s First Wearable Manufacturer

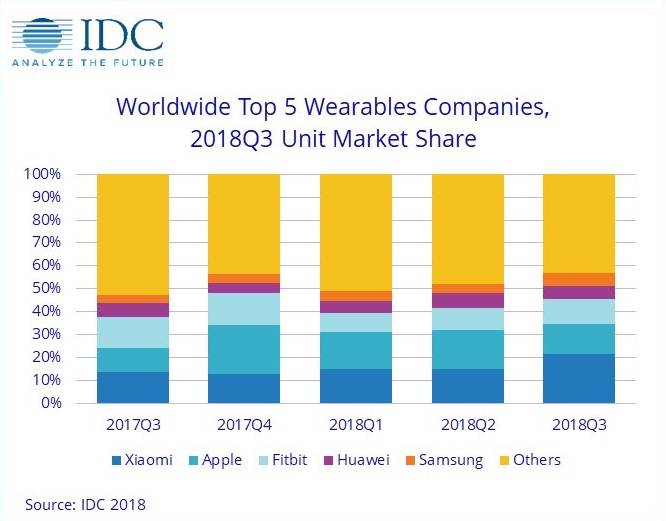

Although IDC’s latest report on wearable devices underscores the continued growth of global demand, the growth is mainly due to the basic wearable device category, rather than high-end smartwatches. Say, Xiaomi achieved a 90.9% year-on-year growth in the third quarter of 2018, becoming the world’s largest supplier of wearable devices, surpassing Apple and Fitbit that are in the second and third, places.

Xiaomi’s shipments increased to 6.9 million units, mainly due to two factors: the launch of the Mi Band 3 and the expansion of overseas markets. The company’s focus has always been on the Chinese market. However, in the third quarter, only 61% of Xiaomi shipments came from the Chinese market, which had been more than 80% in the past. This is because Xiaomi began to sell in Europe, India, Middle East/Africa – this is an ideal area for the cheap wearable sales.

In contrast, Apple chose to launch the Apple Watch Series 4 at a higher price and refused to reduce the previous 1 or 2 series models below the $200 price point. This will greatly affect its market share increase. Even so, the price cuts of the 3 series models have reduced Apple’s shipments by 54% to 4.2 million units. In terms of shipments, Apple has a market share of 13.1%, which is 21.5% behind Xiaomi.

Fitbit’s shipments fell 3.1% year-on-year to 3.5 million units, mainly due to the launch of Versa smartwatches. Huawei ranked fourth, with shipments dropping by more than 20% to 1.9 million units, due to the launch of the TalkBand B5 combination Bluetooth headset and fitness tracker. With the launch of the Galaxy watch, coupled with the price advantage of the Gear S3 and Gear Fit devices, Samsung grew 91% to 1.8 million units.

“Many of the new basic wearables include features like notifications or simple app integrations that bleed into smartwatch territory. This has helped satiate consumer demand for more capable devices while also maintaining average selling prices in a market that faces plenty of downward pressure from low-cost vendors and declining smartwatch pricing,” said Jitesh Ubrani senior research analyst for IDC Mobile Device Trackers. “However, this resurgence of basic wearables should be watched closely as these wearables have historically been popular due to their low price points and simplified set of features. As more features get added and as the price differential between basic trackers and smartwatches narrows, brands could potentially move consumers upstream to smartwatches.”